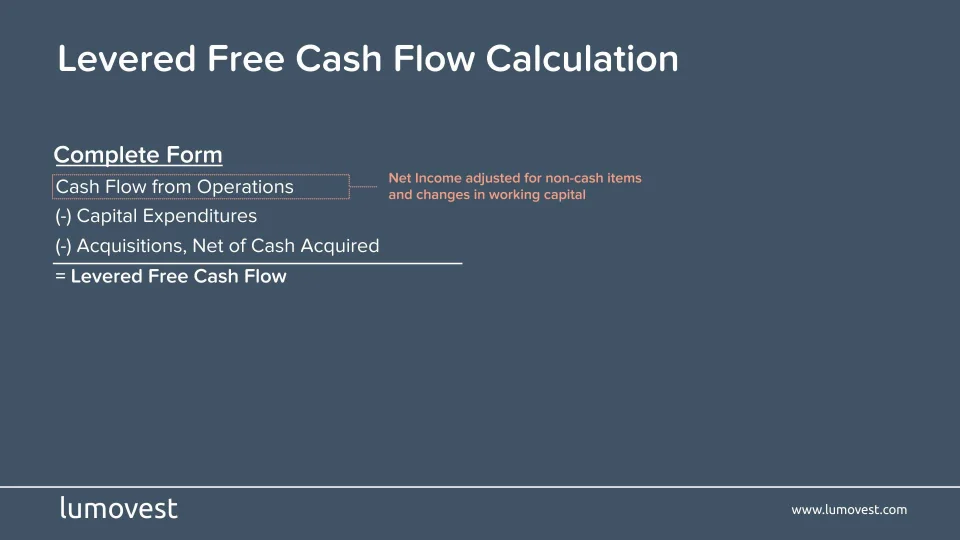

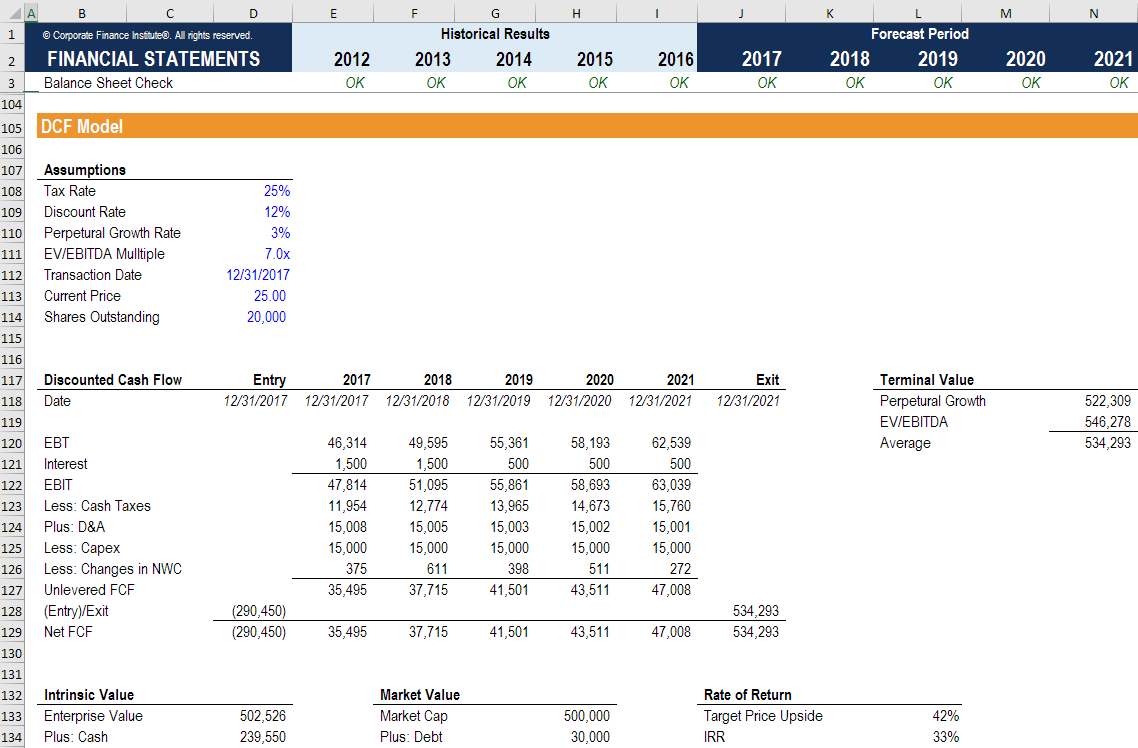

As you can see the free cash flow equation is pretty simple. Once you calculate the terminal value then find the present value of the terminal value.

Free Cash Flow Fcf Yield As An Indicator Of Operating

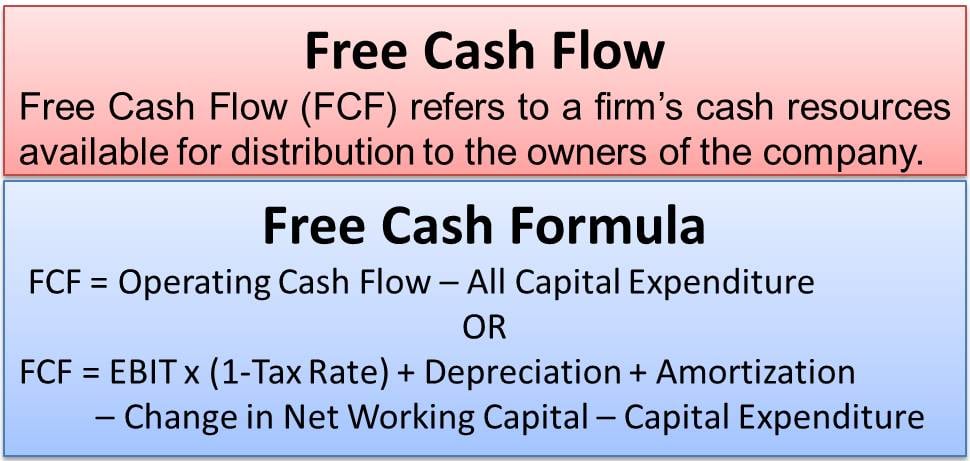

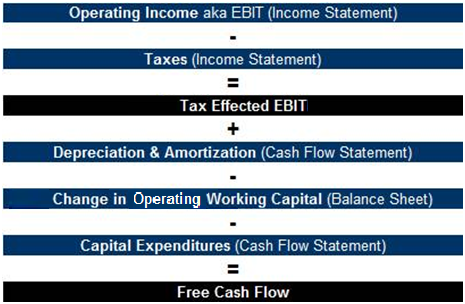

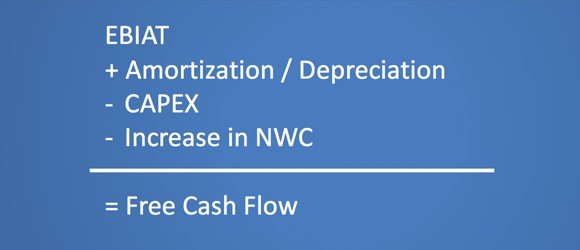

Free cash flow formula. High or rising free cash flow is often a sign of a healthy company that is thriving in its current environment. If fcf of a company is high then it means a company has sufficient fund for a new product launch business expansion and growth of the company but sometimes if a company has low fcf it may possible company will have huge investment and company will grow in long run. Step 5 find the present value. What is the free cash flow fcf formula. The formula for terminal value using free cash flow to equity is fcff 2022 x 1growth keg the growth rate is the perpetuity growth of free cash flow to equity. The generic free cash flow fcf formula is equal to cash from operations cash flow from operations cash flow from operations is the section of a companys cash flow statement that represents the amount of cash a company generates or consumes from carrying out its operating activities over a period of time.

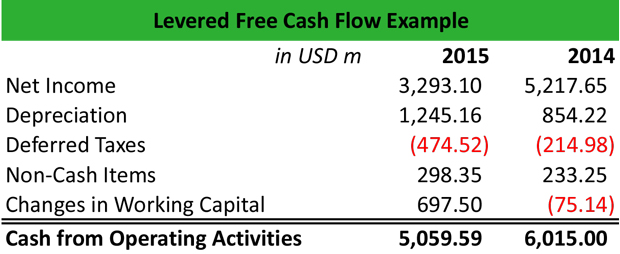

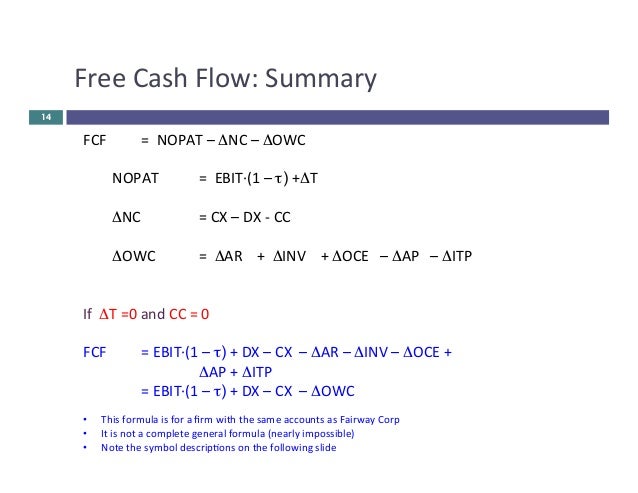

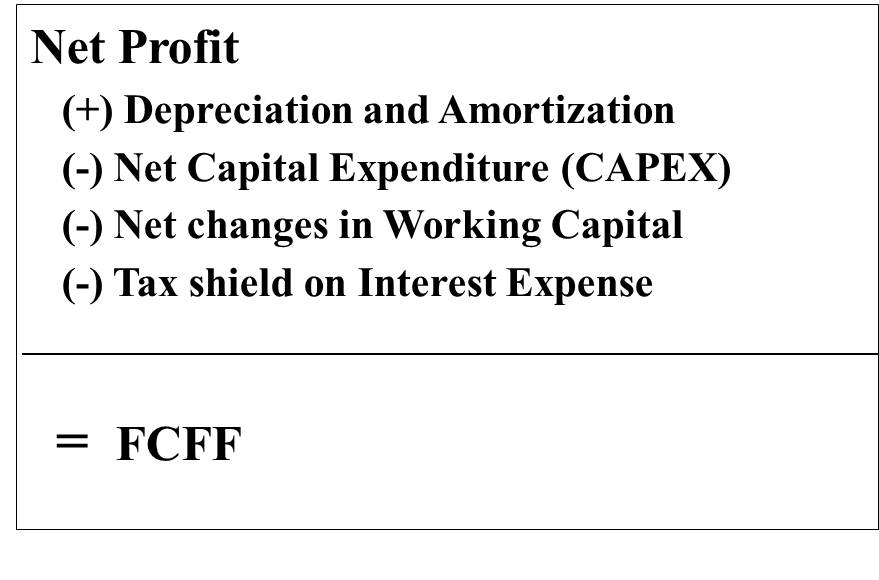

Free cash flow is an important measurement since it shows how efficient a company is at generating cashinvestors use free cash flow to measure whether a company might have enough cash after. To calculate free cash flow all you need to do is turn to a companys financial statements such as the statement of cash flows and use the following fcf formula. Free cash flow formula in excel with excel template here we will do the example of the free cash flow formula in excel. Operating cash flow ocf is the amount of cash generated by the regular operating activities of a business in a specific time period. Cash flow from operations. The free cash flow formula is calculated by subtracting capital expenditures from operating cash flow.

The operating cash flow formula is net income form the bottom of the income statement plus any non cash items plus adjustments for changes in working capital. Benefits of free cash flow fcf because fcf accounts for changes in working capital it can provide important insights into the value of a company and the health of its fundamental trends. It is very easy and simple. Operating activities include generating. Free cash flow matters because the presence of free cash indicates that a company has cash to expand develop new products buy back stock pay dividends or reduce its debt. Free cash flow formula helps to know cash available which have to be distributed among shareholders of a company.

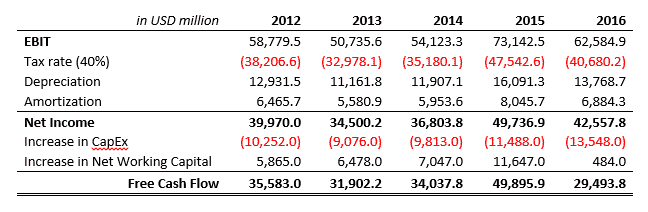

You can easily calculate the free cash flow using formula in the template provided. You need to provide the three inputs ie operating cash flow capital expenditure and net working capital. In our model we have assumed this growth rate to be 3. The ocf portion of the equation can be broken down and be calculated separately by subtracting the any taxes due and change in net working capital from ebitda.